Fraud Risk Safety Protection Surveillance Authority 3756687107 3246217999 3270321718 3888912794 3533371803 3274155619

The Fraud Risk Safety Protection Surveillance Authority operates with a clear mission: to combat fraud through innovative strategies. By leveraging cutting-edge technologies like machine learning and data analytics, the Authority enhances risk assessments. This approach has led to significant reductions in fraud, particularly within financial institutions. However, as fraud tactics evolve, ongoing collaboration with stakeholders remains crucial. The implications of this dynamic landscape warrant further exploration.

Mission and Objectives of the Authority

The mission of the Authority is to establish a robust framework for mitigating fraud risk across various sectors, ensuring the protection of consumers and businesses alike.

This mission statement reflects the organizational goals of fostering transparency and accountability.

Advanced Technologies and Strategies Employed

As organizations confront the evolving landscape of fraud, they increasingly leverage advanced technologies and strategic methodologies to bolster their defenses.

Machine learning algorithms analyze vast datasets, identifying patterns indicative of fraudulent behavior.

Concurrently, data analytics tools enhance decision-making processes, enabling real-time risk assessments.

Together, these innovations create a robust framework that empowers organizations to proactively mitigate fraud risks while maintaining operational efficiency and integrity.

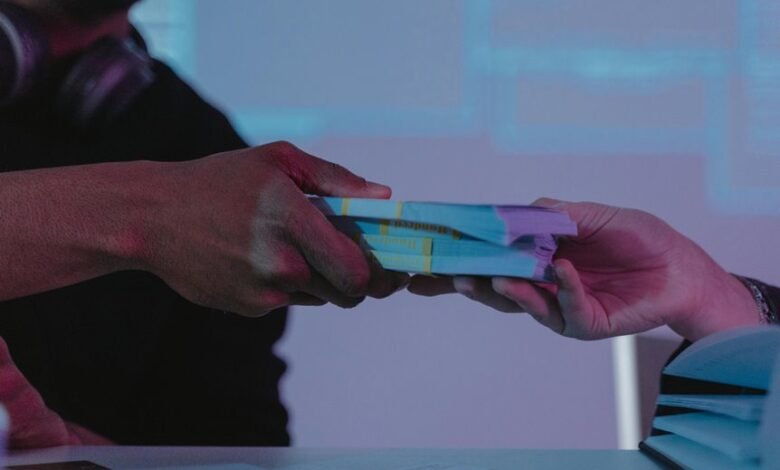

Impact on Consumers and Businesses

While organizations implement advanced fraud protection strategies, consumers and businesses alike experience significant repercussions that merit careful examination.

Increased consumer awareness about fraud risks often leads to heightened expectations for business compliance. Consequently, businesses must balance rigorous security measures with customer trust, as failure to do so can result in reputational damage, loss of customer loyalty, and potential legal ramifications in an evolving regulatory landscape.

Case Studies and Success Stories

Examining the effectiveness of fraud protection strategies reveals a range of successful implementations across various industries.

Case studies demonstrate that companies employing advanced surveillance techniques significantly enhance fraud prevention measures. For instance, financial institutions that integrated real-time monitoring systems reported a 30% decrease in fraudulent activities.

Such evidence underscores the importance of rigorous evaluation of surveillance effectiveness in safeguarding organizational integrity and consumer trust.

Conclusion

In a world where fraudsters seem to have PhDs in deception, the Fraud Risk Safety Protection Surveillance Authority emerges as the overzealous hall monitor, wielding machine learning like a ruler ready to slap the wrist of mischief-makers. While their 30% reduction in fraud might seem commendable, one must wonder if the true victory lies in outsmarting the cleverest of criminals or merely keeping the proverbial schoolyard safe. As they continue their crusade, the question remains: can vigilance ever truly outpace innovation?